With Medicare Supplement plans, you can travel with the peace of mind that you’re covered nationwide

Medicare Supplement plans ensure your coverage is with you when you travel anywhere in the United States. Simply choose any Medicare-approved physician anywhere throughout the country.

With a Moda Medicare Supplement plan, you can feel secure that where Medicare coverage ends, your Moda plan coverage begins.

Save with Moda Medicare Supplement plans

Medicare Supplement plans cover you for some out-of-pocket costs and expenses like coinsurance, copayments or deductibles not paid by Original Medicare.

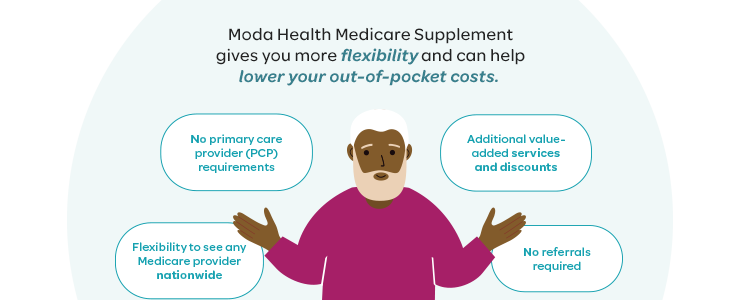

Our plans come with gym memberships, no primary care provider (PCP) requirements and no-referrals needed to see a specialist.

You’ll also get discounted prescriptions and health & wellness programs included. And optional add-ons for vision and hearing coverage.

Moda value-added services and discounts*

- Prescription savings

- Gym membership

- Discounts from popular brands like Garmin® and Vitamix®

- Medical Travel Assist

- 24/7 Nurse Advice line

- Health & wellness coaching

- Individual Assistance Program (IAP)

Support for your health journey

All of our plans come with programs, care teams, tools and resources designed to help you manage your well-being. Your personal Moda Member Dashboard will help you get medical advice from health professionals, work with health coaches, view your explanation of benefits and more.

- Care coordination & case management

- Nurse line

- Health coaching

- Individual Assistance Program (IAP)

Medicare Supplement brochures

Explore our Medicare Supplement plans to see which option is right for you. We offer a variety of plans to meet your wellness needs.**

| Plan options | A | B | C | D | F F1 | G G1 | K2 | L2 | M | N3 |

|---|---|---|---|---|---|---|---|---|---|---|

| Basic benefits | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Skilled nursing coinsurance |

✓ | ✓ | ✓ | ✓ | 50% | 75% | ✓ | ✓ | ||

| Part A deductible | ✓ | ✓ | ✓ | ✓ | ✓ | 50% | 75% | 50% | ✓ | |

| Part B deductible | ✓ | ✓ | ||||||||

| Part B excess (100%) | ✓ | ✓ | ||||||||

| Foreign travel emergency |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

*Value-added services are a complement to the plan but are not insurance. These additional services may be discontinued at any time. Services and programs vary by plan.

**Not all plans available in all locations.

1Plans F and G also have a high deductible option which require first paying a calendar-year deductible of $2,800 before the plan begins to pay. Once the deductible is met, the plan pays 100% of covered services for the rest of the calendar year. Plan High-deductible G does not cover the Medicare Part B deductible. However, Plan High-deductible F and Plan High-deductible G count your payment of the Medicare Part B deductible toward meeting the calendar-year deductible.

2Plan K reimburses these expenses at 50%, up to an out-of-pocket maximum of $7,060 in a calendar year. Plan L reimburses these expenses at 75%, up to an out-of-pocket maximum of $3,530 in a calendar year. Once the out-of-pocket maximum is met, covered expenses are reimbursed at 100%.

3Plan N requires copayment of up to $20 for office visits and $50 for emergency room visits.

Eligibility:

If you live in Idaho or Oregon, you are eligible for Medicare under the age of 65 if you have been diagnosed with any of the following:

- End-stage renal disease (ESRD)

- Lou Gehrig’s disease (ALS)

- Permanently disabled (and have received disability benefits for at least 24 months)

Shop plans

Contact us

Call 844-274-9122 to contact a Moda Health agent. TTY users, please call 711. Customer Service can be reached at 844-235-8012.

Last updated Oct. 1, 2023